Prime Water View Limited, a property developer, and its executive chairman, Mr Tunji Ogunwusi, are at the centre of a court case in which about a dozen subscribers who bought houses in Ashake Court within the Oniru Family Chieftaincy Estate are at the risk of losing their multi-million naira investment. Prime Water View was the developer of the Ashake Court which it sold to the subscribers.

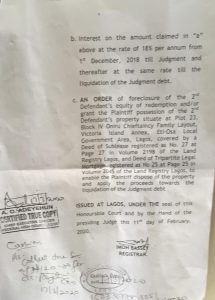

Unknown to the house owners in the Ashake Court, Mr Ogunwusi had used their property as collateral for a bank loan which he did not pay back. Now the bank, FCMB, has taken over the houses and locked out their owners based on the judgment of the Federal High Court in Lagos.

The dodgy deal came to light last month (26 August 2020) when a combined team of policemen and OPC operatives stormed the Ashake Court in the early hours of the morning to drive out people from their homes and lock up the place, brandishing court documents as evidence that the FCMB Bank had obtained a foreclosure judgment on the property in settlement of a loan that Mr Tunji Ogunwusi and Prime Water View Limited had taken from the bank with the Ashake Court as collateral but did not pay back.

Mr Ogunwusi, who is now the executive chairman of Prime Water View Limited, was the managing director of the company at the time the subscribers entered into agreement with the property developer to buy 12 units of flat, including a pent house, at the Ashake Court for over N500 million and paid for in full by early 2009, but Prime Water View did not release the original title documents to any of the subscribers.

However, in November 2009 Mr Ogunwusi used the original title documents of the houses he had already sold to obtain a loan of N100, 000,000 from FCMB. He failed to service the loan.

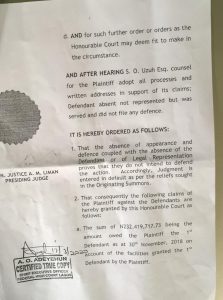

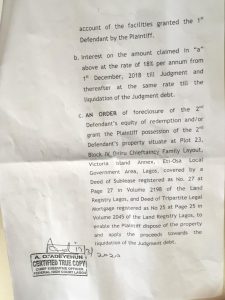

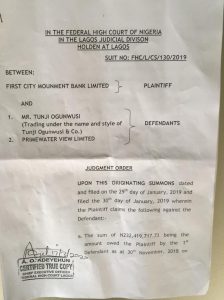

In January 2019 the bank took Mr Ogunwusi and his company to court in a suit numbered FHC/L/CS/130/2019, claiming N281 million in capital and accumulated interest on the loan. Mr Ogunwusi failed to show up and defend himself in court despite being served all the court processes. The court, presided over by Justice A.M Liman, granted the prayers of the bank in a judgment in March 2020.

In a tripartite meeting attended by Mr Ogunwusi’s lawyer, the property owners and the bank following the execution of the court judgment, Ogunwusi asked the property owners to pay the bank, promising to reimburse them later. The property owners, afraid of losing their investment, pleaded with the bank to allow them repay only the capital of N100, 000,000 but the bank refused, offering to forgive just 40 per cent of the accumulated interest in any negotiated settlement.

In a statement in Lagos over the weekend, the Ashake Court subscribers

said, “It is curious Mr Ogunwusi is not ready to settle a debt of N100 million over a property he sold for more than N500 million.”

said, “It is curious Mr Ogunwusi is not ready to settle a debt of N100 million over a property he sold for more than N500 million.”

The property owners are concerned that were they to afford the extra payment as demanded by the bank, their property would be so hopelessly overpriced that it would be impossible to sell without significant losses.

They are also not happy that the bank is forcing them to pay for its failure to carry out due diligence to determine the true ownership of the houses before accepting them as collateral for a loan to Ogunwusi and his company.

They equally fault the bank for continuing to book interest on a facility that had gone bad contrary to CBN guideline that once a loan has become non-performing for six months banks should not continue to book interest on it.

Prime Water View Limited has been involved in legal disputes over the years with subscribers to its housing schemes and financial institutions over loan obligations and delivery of houses paid for. Recently PHB Asset Management approached the Federal High Court in Lagos with prayers to wind up the property developer over N1.9 billion debt the financier claimed against the property company.

Prime Water View also had a case in 2014 with ExxonMobil Cooperative Society which alleged in court documents that it paid N1.37 billion in 2008 to the developer for 127 units of houses in an estate in Ikate-Elengushi which the cooperative lost to Sterling Bank because the property was used as a collateral by Prime Water for a loan from the bank, which later seized the property through the order of a court because the developer did not pay back the loan it took from the bank.

Leave a Reply